wichita ks sales tax rate 2019

The 75 sales tax rate in Wichita consists of 65 Puerto Rico state sales tax and 1 Sedgwick County sales tax. The County sales tax rate is.

Wichita Property Tax Rate Up Just A Little

Subscribe to our Newsletter Submit.

. Arts Business District. New sales and use tax rates take effect in the following cities counties and special jurisdictions on July 1 2019. It also includes the City owned Chester Lewis Reflection Square Park and parking lot at William and Broadway.

The most common methods of assessment are the square foot basis and the fractional basis. Sales tax region name. In Wichita the rate is six percent.

Tax rates last updated in April 2022. You can print a 75 sales tax table here. Average Sales Tax With Local.

Divide Line 15 by Line 23 and multiply by 10018 0706083100 25. With local taxes the total. In 2019 it was 32721 based on the Sedgwick County Clerk.

Secretary Burghart has more than 35 years of experience combined between private and public service in tax law. Resident will owe Kansas use tax of 895 current Anytown rate on the total charge of 2000 when that resident brings the laptop computer back to Anytown KS. The minimum combined 2022 sales tax rate for Wichita Kansas is.

Enter amount from full year. The combination of our expertise experience and the team mentality of our staff assures that you will receive the close analysis. If the square foot basis is used each property owner will be responsible for a share of the project cost relative to the square footage of hisher lot.

This is the total of state county and city sales tax rates. Broadway Avenue as well as 212 221 and 223 E. Sales tax collected and spent on MO expenses in 2018.

BFR CPA LLC is one of the leading tax and accounting firms in Wichita Kansas and the surrounding area. This table shows the total sales tax rates for all cities and towns in Sedgwick. No City Sales Tax.

The Kansas sales tax rate is currently. Wichita City Council is raising the sales tax from 75 to 95 - a 27 increase - in a community improvement district near the new baseball stadium and on. Wichita collects the maximum legal local sales tax.

The rates listed below include the state sales tax rate of 65. The Wichita sales tax rate is. The 2 sales tax will be distributed on a.

View City Fee Resolution PDF to see established fees and charges effective October 2019. SALES TAX WH TAX INCOME RESPONSIBLE PARTY TAX TYPE. There is 0 additional tax districts that applies to some areas geographically within Herington.

Sales Taxes Amount Rate Wichita KS. Kansas sales tax changes effective July 1 2019. Buildings at 105 and 124 S.

For tax rates in other cities see Puerto Rico sales taxes by city and county. There is no applicable city tax or special tax. State Sales Tax.

The Washburn University School of Law and his Masters of Laws in Taxation degree from the University of Missouri at Kansas City in 1984. Standard deduction one exemption - Sales Tax includes food and services where applicable. City of Wichita Falls Taxing Unit Name Phone area code and number Taxing Units Address City State ZIP Code Taxing Units Website Address.

The 75 sales tax rate in Wichita consists of 65 Kansas state sales tax and 1 Sedgwick County sales tax. No Local Income Tax. Therefore larger lots will pay more than smaller lots.

The total sales tax rate in any given location can be broken down into state county city and special district rates. 31 rows The state sales tax rate in Kansas is 6500. You can print a 75 sales tax table here.

As well as continue the redevelopment of downtown Wichita. Rehabilitation of the Kechi Playhouse. If the fractional basis is used each lot in.

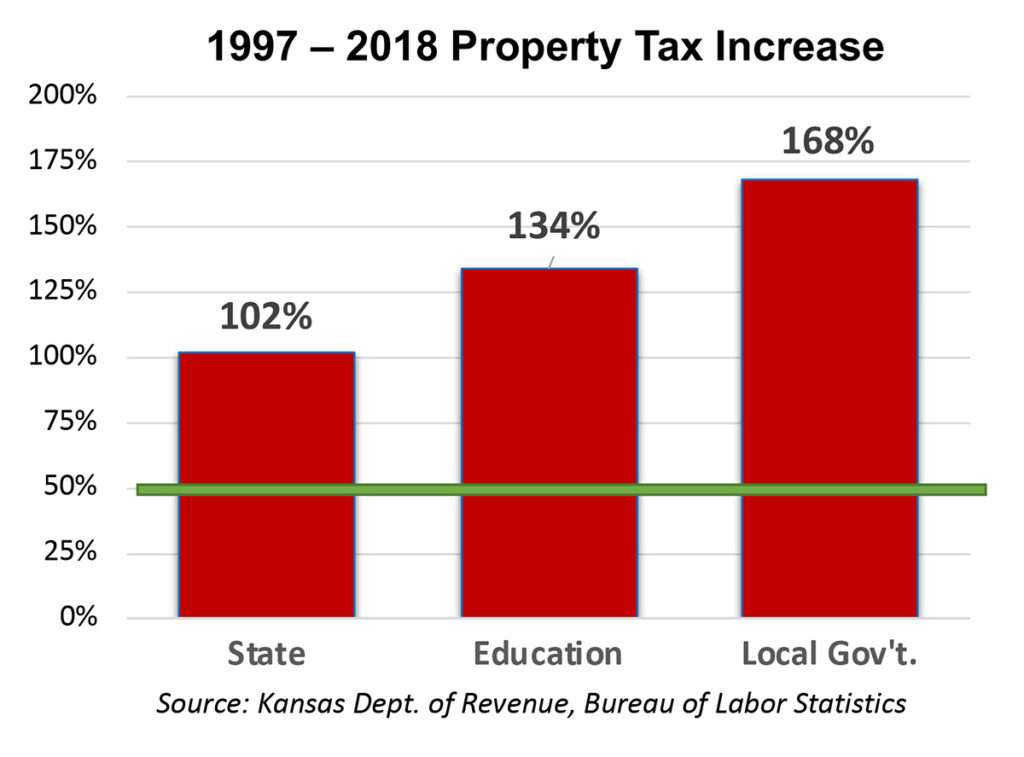

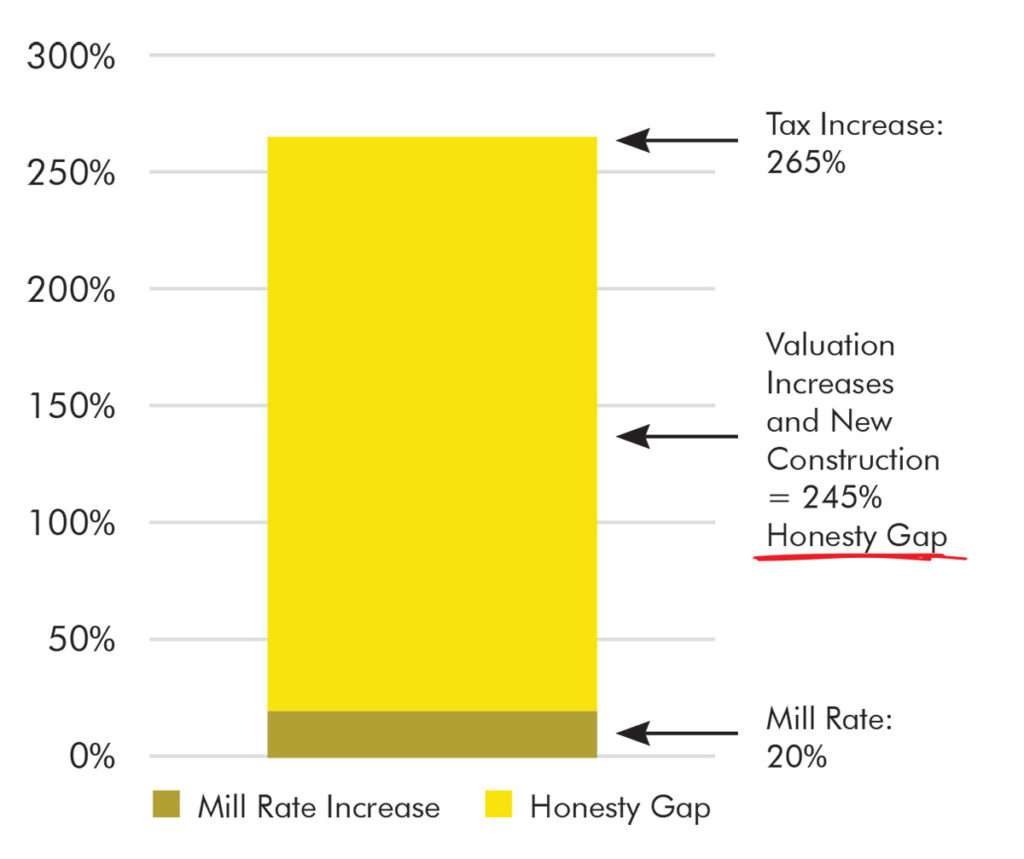

Sales Tax Breakdown. Kansas has state sales tax of 65. Thats an increase of 1431 mills or 457 percent since 1994.

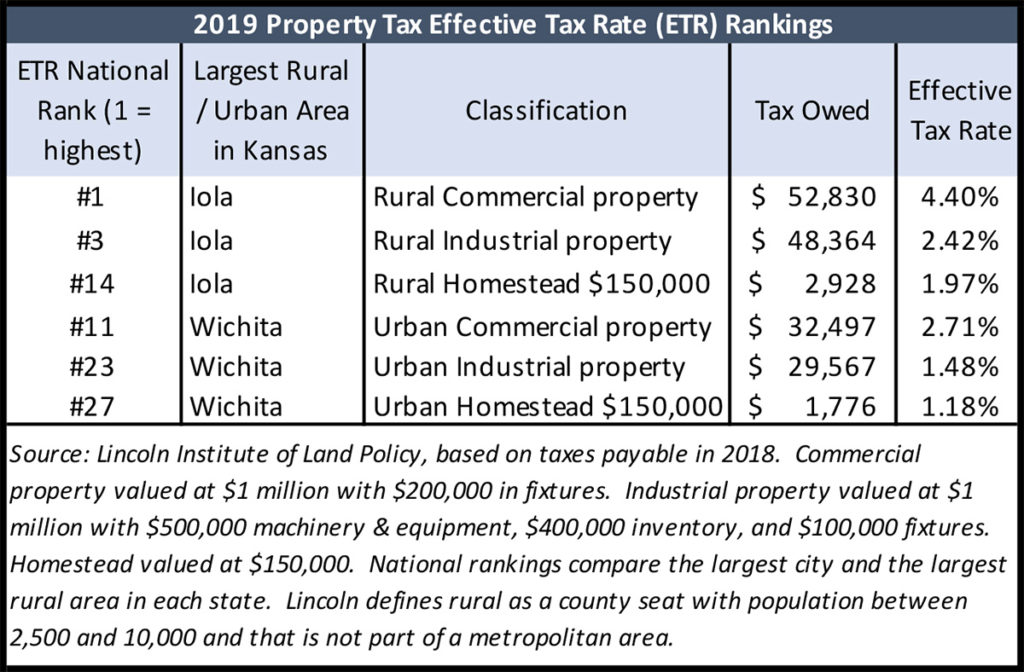

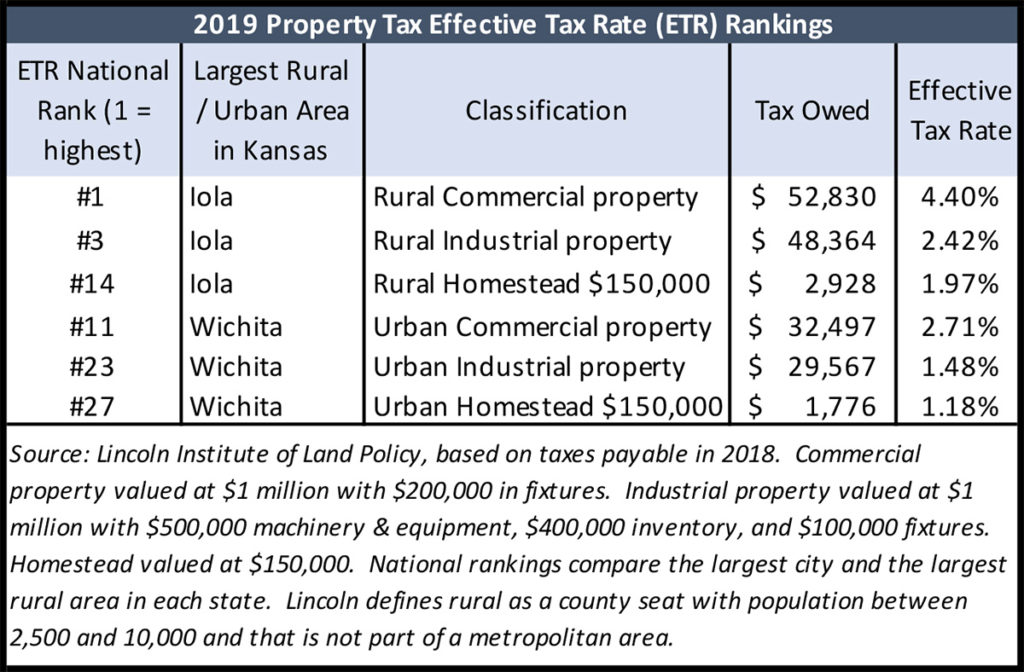

These are for taxes levied by the City of Wichita only and do not include any overlapping jurisdictions Wichita mill levy rates. On March 26 2019 the Kansas Senate confirmed Mark Burghart as the Secretary of Revenue. 2019 effective tax rate.

For tax rates in other cities see Kansas sales taxes by city and county. Kansas has a 65 sales tax and Sedgwick County collects an additional 1 so the minimum sales tax rate in Sedgwick County is 75 not including any city or special district taxes. State Income Taxes.

While the Kansas Department of Revenue collects the tax the proceeds are returned to the cities or counties except for a two percent processing fee. 3 lower than the maximum sales tax in KS. There is no applicable city tax or special tax.

The tax is collected as a percentage of total room revenue not the number of rooms or the rate charged for rooms.

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Sales Tax On Cars And Vehicles In Kansas

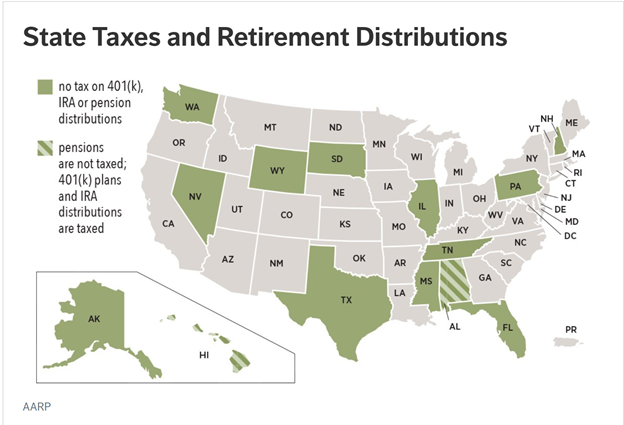

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute

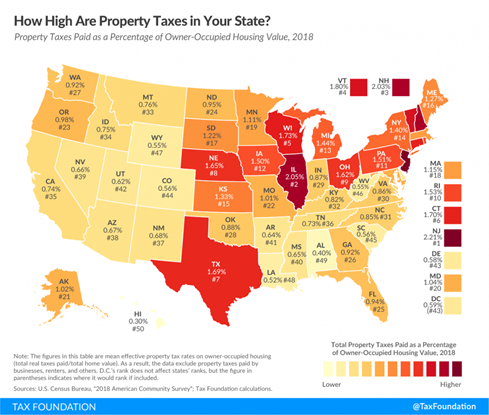

5 Things You Need To Know About Property Taxes In Kansas Kansas Policy Institute

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute

Kansas Sales Tax Guide And Calculator 2022 Taxjar

Wichita Property Tax Rate Up Just A Little

/cloudfront-us-east-1.images.arcpublishing.com/gray/MVMWZY7JTZC5HK6TDJ44RACC34.JPG)

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

5 Things You Need To Know About Property Taxes In Kansas Kansas Policy Institute

File Sales Tax By County Webp Wikimedia Commons

5 Things You Need To Know About Property Taxes In Kansas Kansas Policy Institute

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

Kansas Income Tax Calculator Smartasset

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates